Learning notes: staking on Ethereum

This post is not investment advice, so I intentionally avoid mentioning specific staking providers. If you find any information unclear/incorrect, just let me know as I'm also learning. 🙏

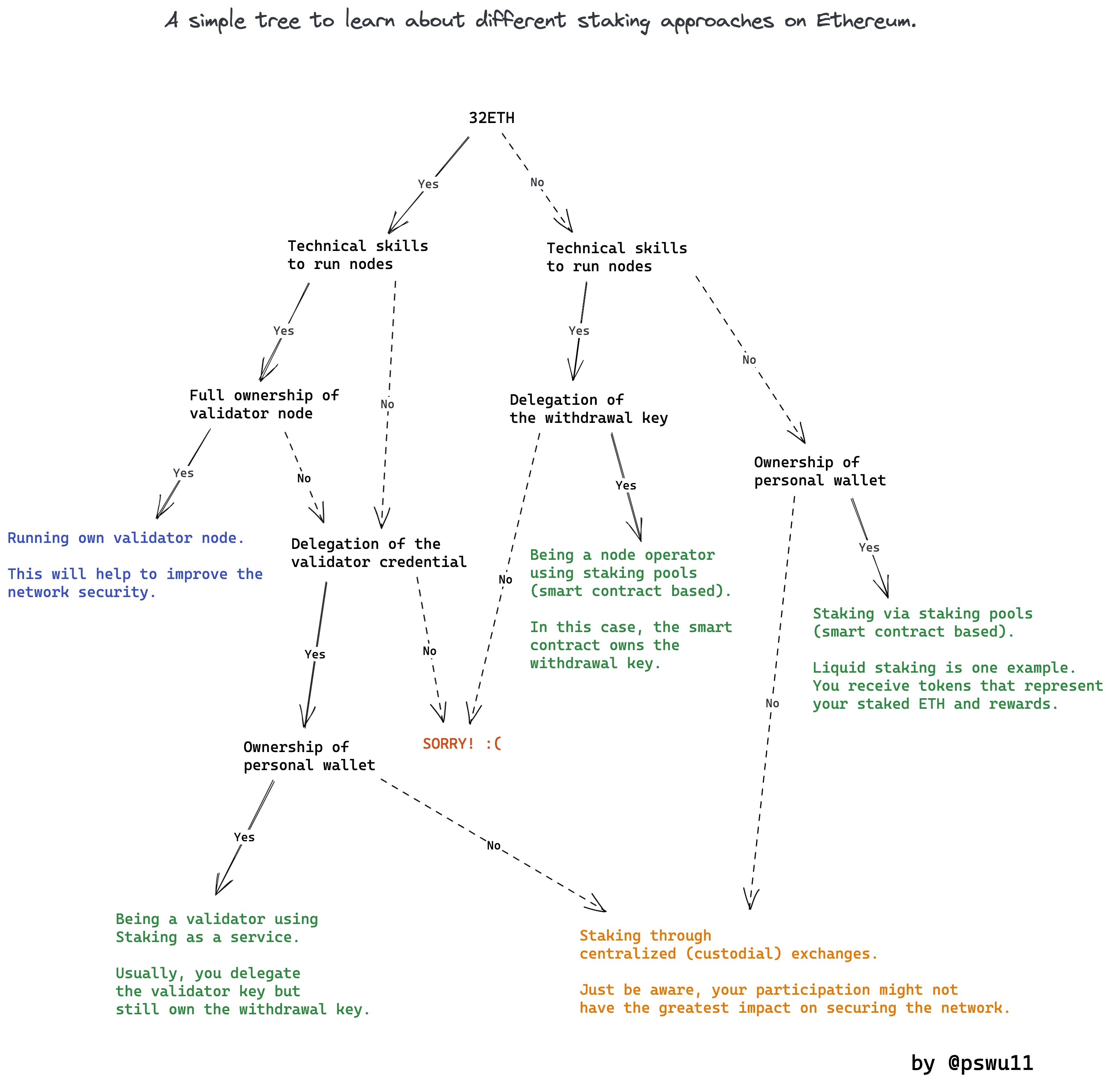

We talked about staking during the recent SheFi session. And I noticed it is among the most confusing topics for many other SheFi memebers, including myself. It's not hard to grasp the concept of why staking is necessary for security and decentralization, and why it might be an interesting way to invest. But with all the staking options out there, what are the differences? While learning about this, I created a mental map to organize my thoughts. I'd like to share this mental map and my train of thoughts in this blog post, and hopefully it's helpful for others who are also learning the same topic.

I use a tree graph to highlight relevant traits and requirements of different staking options from the perspective of stakers:

To add more context to the tree graph above, I also put together a list of (non-exhaustive) questions a potential staker could ask when evaluating different staking providers (especially staking pools) and why these questions matter.

Can I stake using a non-custodial wallet?

This is the key to determining whether you have full ownership of your staking rewards. You might have heard people saying - staking pools are decentralized, so your rewards are safe. Be careful not to take it too literally because it's based on many assumptions[^1]. If you participate in staking pools using a custodial exchange, the tokens technically go to your custodial wallet. So you don't truly own them until you transfer them back to your non-custodial wallet.

Is the staking process based on a smart contract?

It's worth noticing that not all staking pools are based on smart contracts. Therefore, not all of them are decentralized. It's more ideal when smart contracts own[^2] the whole staking process, not the node operators or the service providers. Also, there should be a built-in incentivization mechanism to prevent malicious node operators. That said, not all smart contracts are secure, so you should ask more questions.

Has the smart contract (or even other parts of the system) been audited? If so, has the team published the audit reports?

There are many staking pools out there that are based on smart contracts. But we know that smart contracts are written by humans, and humans make mistakes. It's important to observe whether the developers behind the project have done their best to secure the system and resolve the vulnerabilities found. One indicator would be whether they have sought smart contract auditors to audit their code AND whether they have published the reports with follow-up actions.

Who controls the withdrawal key?

If you are more technical, you might even want to understand who controls the withdrawal credentials. For example, some staking pools make node operators delegate their withdrawal keys to a smart contract, which points to the staking pools. This prevents the node operators from withdrawing staked ETH or excessive rewards. To learn more about the withdrawal key, you could refer to the Ethereum documentation.

What is the liquidity of staking pools?

In normal staking, your staked ETH becomes illiquidable. But in liquid staking, a type of staking pool, you receive ERC-20 tokens that represent your staking rewards. You could then reinvest these tokens or use them as collateral. The liquidity doesn't only depend on whether the token is ERC-20 (fungible); it's also relevant to check whether you could resell your tokens back to the platform, the trading volumes of this token, and what the ratio vs. ETH is, etc., depending on your own investment preference.

Is the project open-source?

A common misconception is that being open-source only means publishing the code. Indeed, code transparency is one of the benefits of being open source. However, being open source also means the project welcomes community feedback, issues, and contributions. It's important to note that open source is not proof of secure code or trustworthiness, even though an active open source community is often seen as a positive signal.

[^1]: In some occassions, stakings pools is used interchangeably with smart-contract based liquid staking, and it's assumed that users interact with the platform using a non-custodial wallet.

[^2]: Note that smart contracts could also have some owner addresses with unreasonable privileges that compromise security.

At last...

Thank you for reading until here. Let me know if you feel any key information needs to be included to help more people understand this topic! Happy to exchange ideas!

Special thanks to Polygon for sponsoring my participation at SheFi! 🫶

References:

- Ethereum Staking Page

- SheFi Course Material